- The Edge

- Posts

- The Economy vs. Your Property Management Business

The Economy vs. Your Property Management Business

Can we expect a soft landing?

There is an old Chinese proverb:

耳听为虚,眼见为实

What you hear may be false, what you see is true.

When it comes to the economy, these words couldn’t be more true. It’s been arguably four of the most unpredictable years many of us have ever seen. From the pandemic to the years that have ensued, rent growth skyrocketed and cooled almost as quickly. There’s been extensive pessimism about the economy and an ensuing recession, but much like the Chinese proverb: what we are seeing looks more like a soft landing.

For those of us who don’t have economist friends, a soft landing is a cyclical slowdown in economic growth that ends without a period of outright recession. A soft landing occurs when the central bank seeks to raise interest rates just enough to stop an economy from overheating and experiencing high inflation, but not enough to cause a severe downturn.

Some would argue that soft landings are as rare as a property management office that never gets calls from renters or owners. How rare is it? The Federal Reserve has managed to achieve only one soft landing in the past 60 years— between 1994 and 1995.

So what does this all mean for the rental housing industry? I was fortunate enough to join the invite-only LeaseLock Forum this week in Chicago where two chief economist shared their insights into what the future holds for our industry over the next couple years.

In this issue of The Edge, we’ll unpack the insights shared by economists Carl Whitaker from RealPage and Greg Willett from Marcus & Millichap.

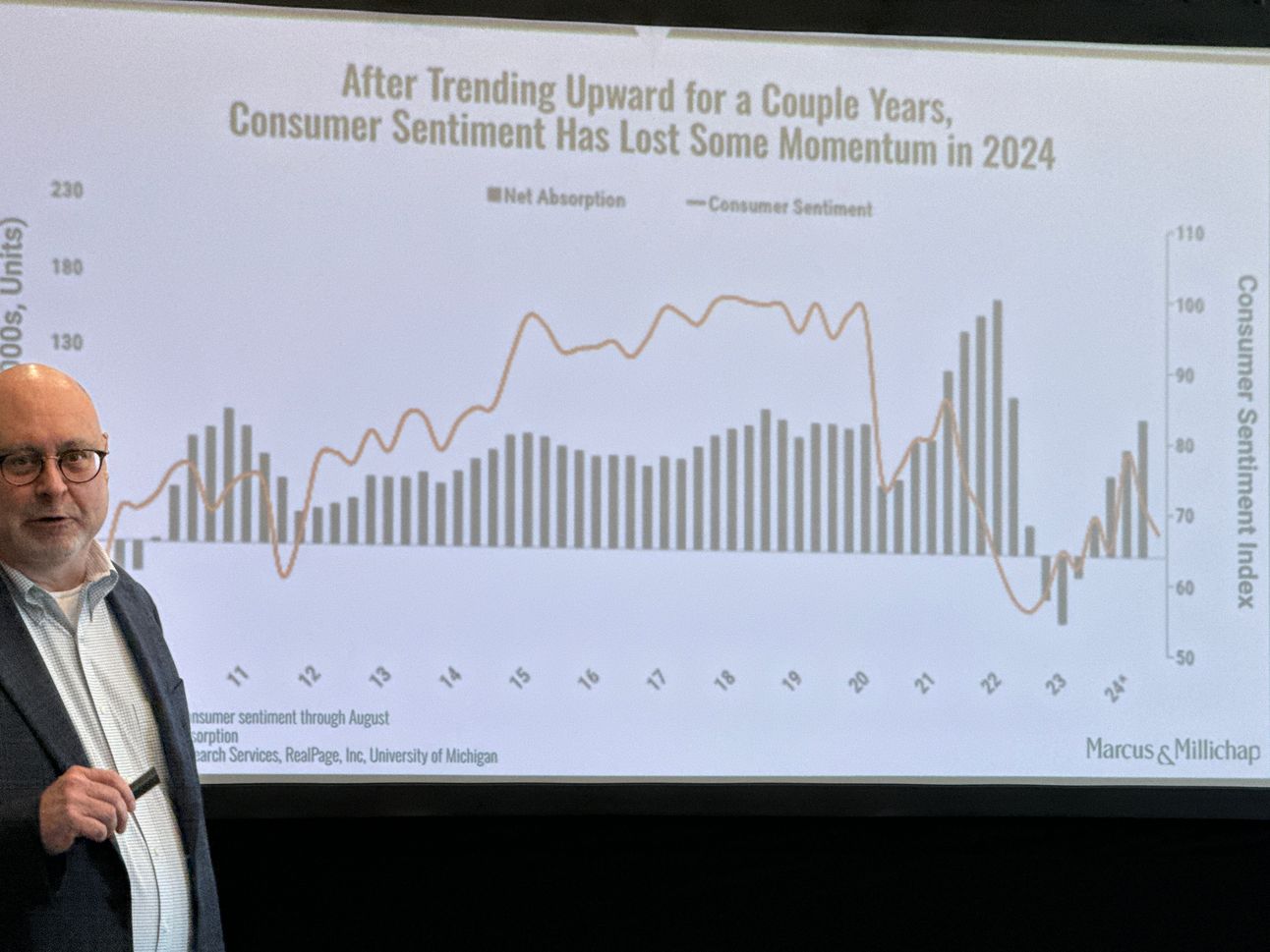

What do consumer sentiment and sausages have in common?

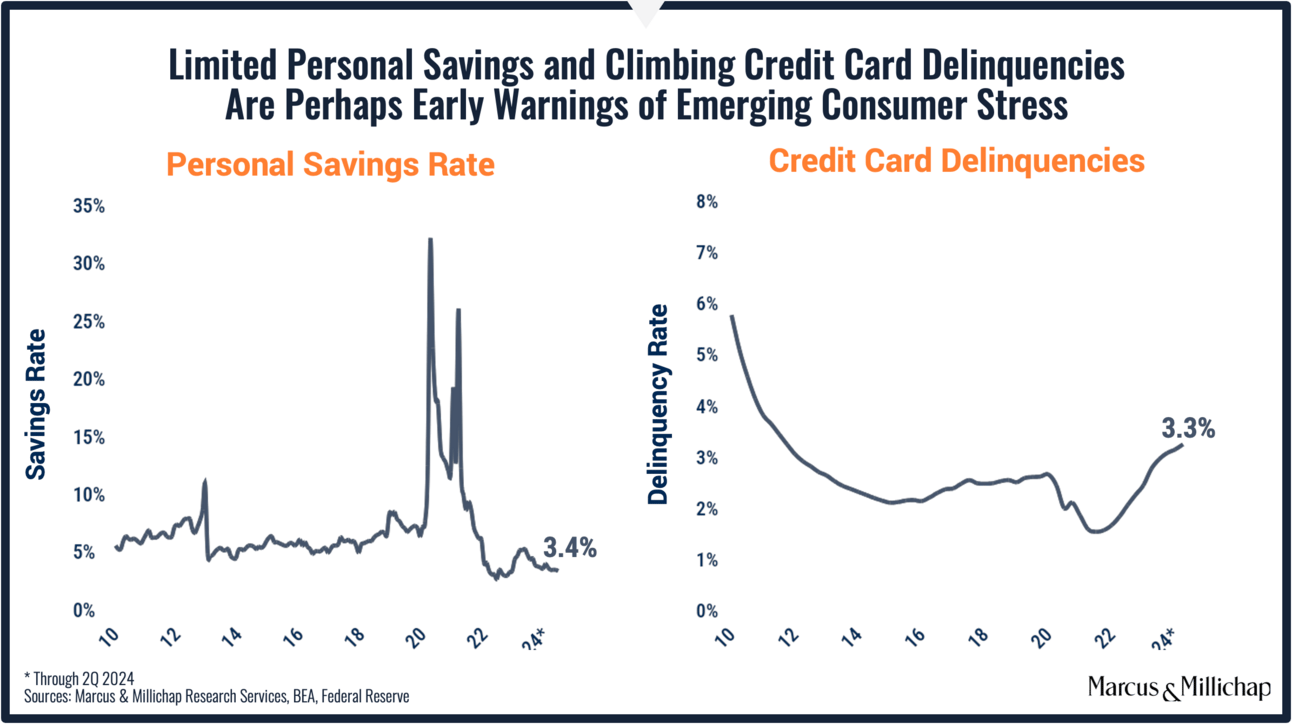

Greg Willett kicked things off by correlating consumer sentiment with housing absorption. While he admits it’s an unconventional way to analyze economic data, there’s been an interesting connection between how people feel about the economy and the absorption of available housing in the U.S. As we wind down the year, it’s clear that consumer sentiment is dipping. There was another obvious and noticeable trend here too. When you’re in an election year (like 2024) people generally have a “doom and gloom” mindset and become more conservative with their spending decisions. There’s plenty of evidence in consumers pulling back spending and signs of struggles ahead. Possible indicators include a decline in consumer personal savings rates and an increase in credit card delinquencies.

Willett even threw out the Texas Sausage Index (who knew it even existed) as a great indicator of a tightening economy. Apparently, when consumers are trading out more expensive forms of protein for sausage, industries should take notice in the shift in spending. This all conjures up memories of the iconic movie Trading Places.

Spending might be tightening, but rental markets are stable

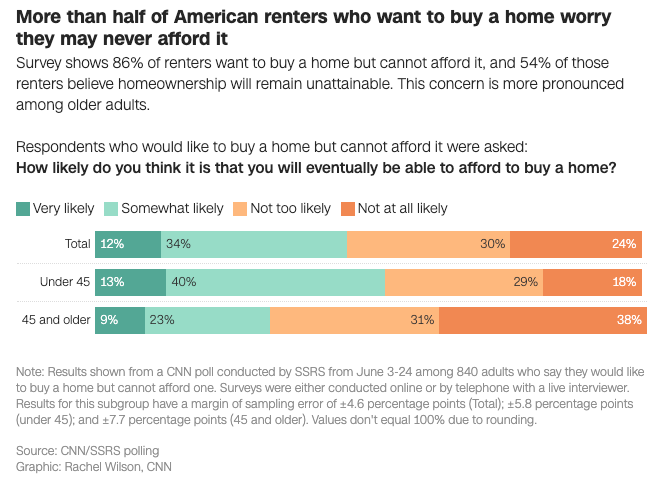

Analyzing trends in home sales is another great method to predict the future for home rentals. While there’s clearly a segment of lifestyle renters nationwide, many would like to own a home. The vast majority (86%) of current renters in the United States say they would like to buy a home — but can’t afford one, according to a CNN poll conducted by SSRS.

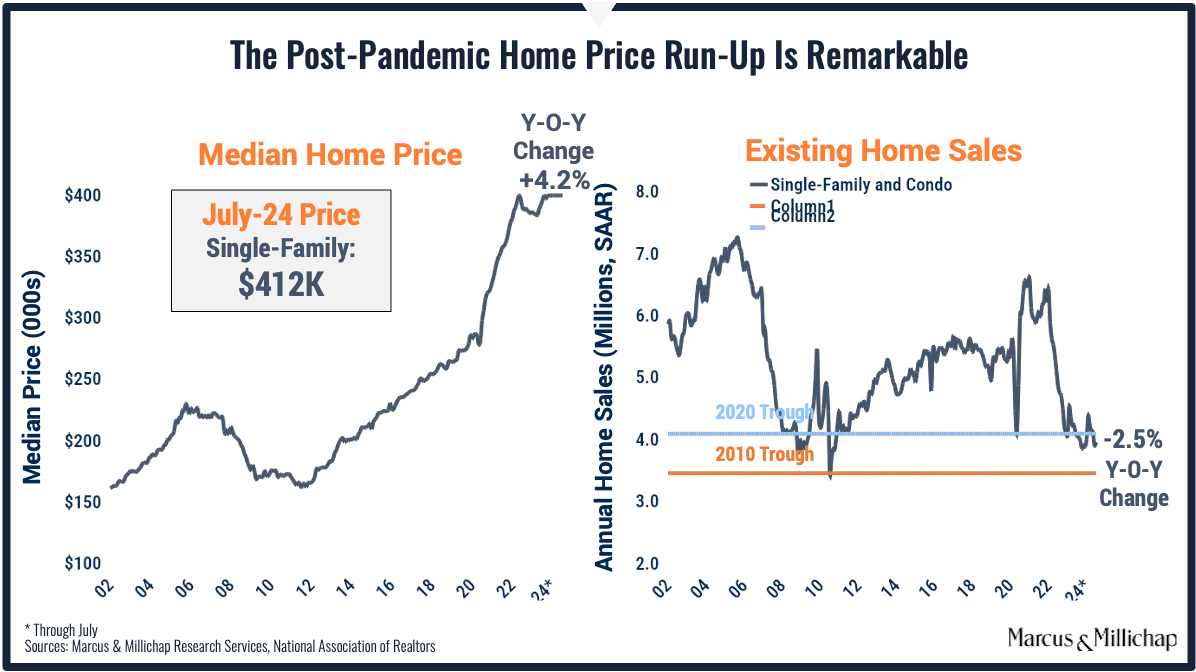

The prospect of home ownership is feeling more bleak for consumers based on a variety of factors, including the incredible run-up in the median home prices in the U.S.

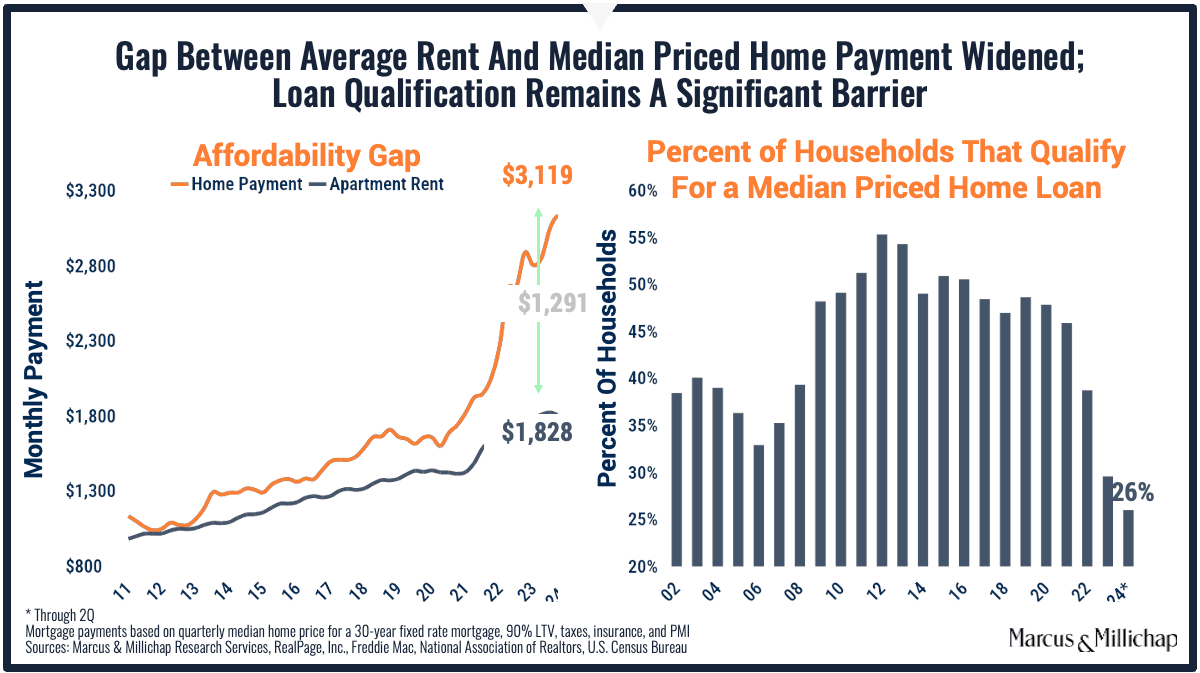

Both Willett and Whitaker argue that there’s a meaningful gap between home ownership payments and apartment rents, with a declining percentage of households that qualify for home loans.

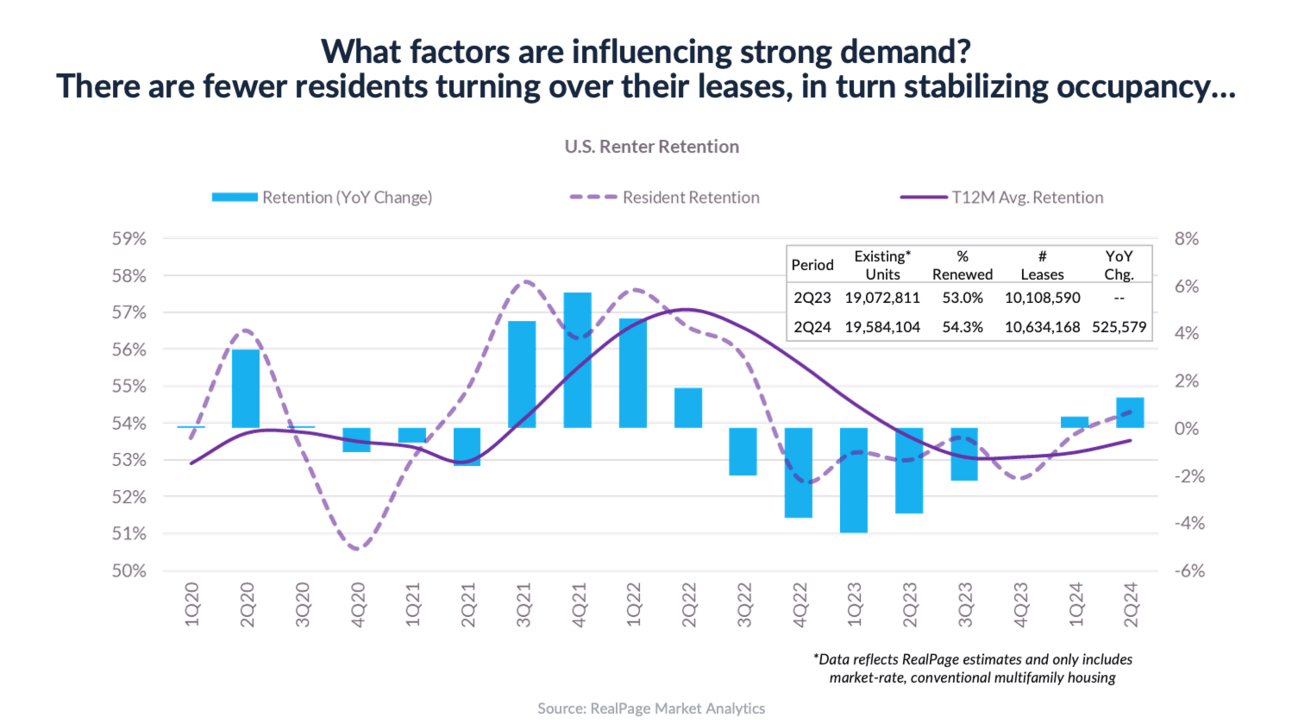

All evidence points to the home rental markets continuing to stay strong through the end of 2024 and well into 2025.

5 strategies for leveraging economic data in your business

While the trends in the economy are thought provoking, you might be wondering how it should affect your strategies for 2024 and beyond. Here are some ideas to consider as you wrap up the summer leasing season:

#1 - Analyze the demand for your listing and revisit rental rates

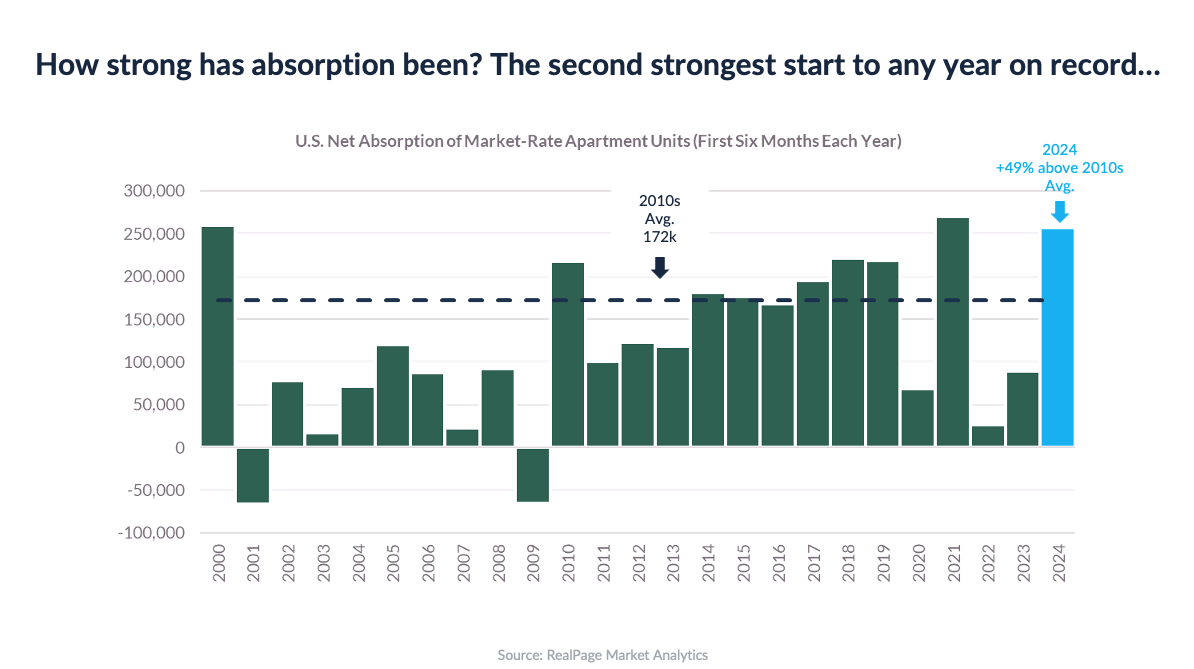

Whitaker shares interesting data about the U.S. net absorption rate of market-rate apartments in the first six months of each year as of year 2000 and it illustrates that 2024 is off to a historic rate. Nearly three-quarters of all new construction in the pipeline is expected to deliver within the next 12 months, leading to a significant supply peak. This excess rental inventory will test the market’s ability to absorb new units.

This might be an opportunity to push rental rates up before inventory spikes, but you should consider these variables before doing so:

Average number of leads per listing month-over-month

Average number of applications per listing month-over-month

Average days on market per listing month-over-month

Current inventory broken down by the count of bedrooms and baths

An increase in leads and applications with a low number of days on market are a good indicator of the ability to absorb an increase in rents. Ideally you are looking at this data by location and property type (beds/bath + square footage) to understand demand in your market before making adjustments to your available inventory.

#2- Pricing strategies at lease renewal

As competition for available space increases, property values tend to go up. This means homeownership is likely unattainable, with renters more likely to renew a lease for a premium.

There’s a huge opportunity to start your lease renewal process earlier now and test pushing rental rates up when occupancy’s stable and competition for new rentals are heating up.

#3 - Target the right renters, while attract those looking to move into your markets

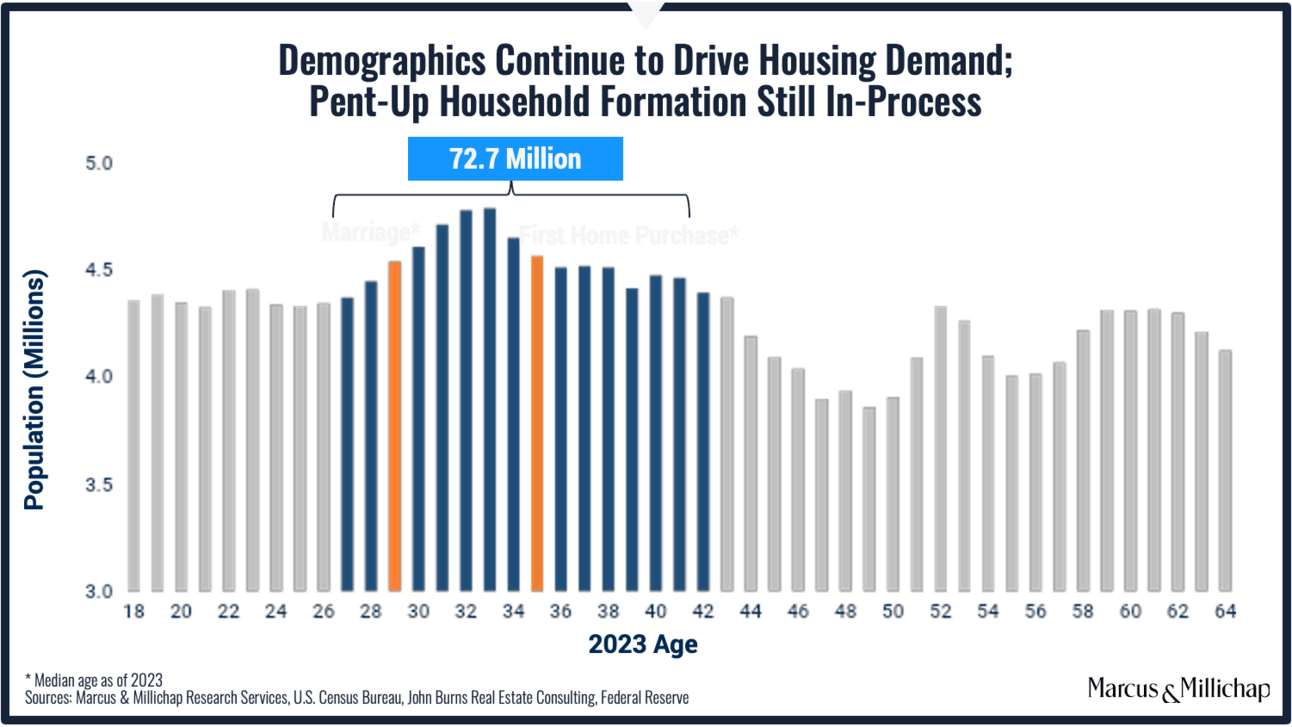

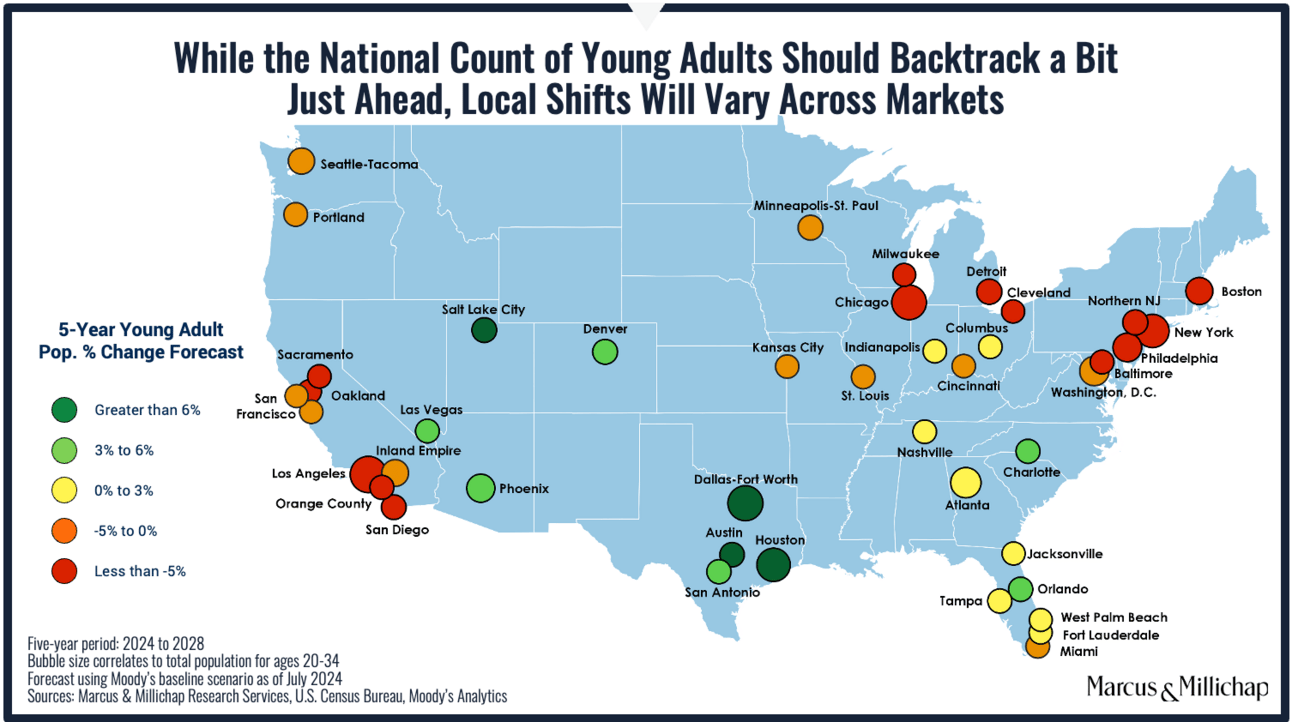

Both Willett and Whitaker spoke about the demographics that are driving our housing demand and the shift from Millennials to Gen Z.

It’s an opportunity to revisit your listings and position amenities and benefits that appeal to this audience.

According to a FICO survey, 29% of Gen Z consumers don't have a credit score or don't know if they have one.

If Gen Z is the new target, why not help them build credit? We recently conducted a webinar with our partners at CredHub where we talked about positioning positive credit reporting as a benefit included with your rentals. It’s easy to implement with a value proposition that appeals to renter, owners, and managers alike.

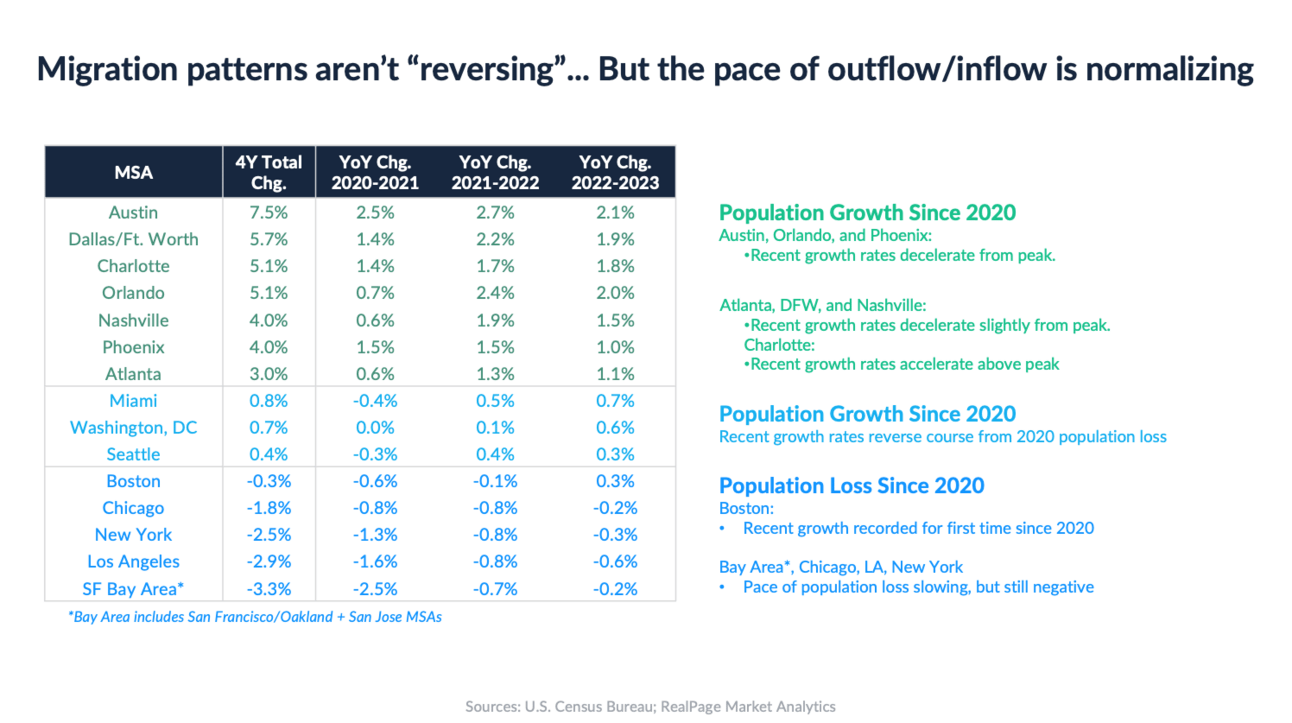

Willet and Whitaker also shared data about how this target market also seems to be migrating to markets where housing is more affordable and employment is on the rise.

It’s worth testing marketing strategies (think landing pages, forums, SEO, and targeted ads) in markets where migration patterns are happening.

Renters moving from these markets are typically trying to learn about neighborhoods, weather, transportation and other factors. Jump into these forums and answer questions while directing folks to your listings

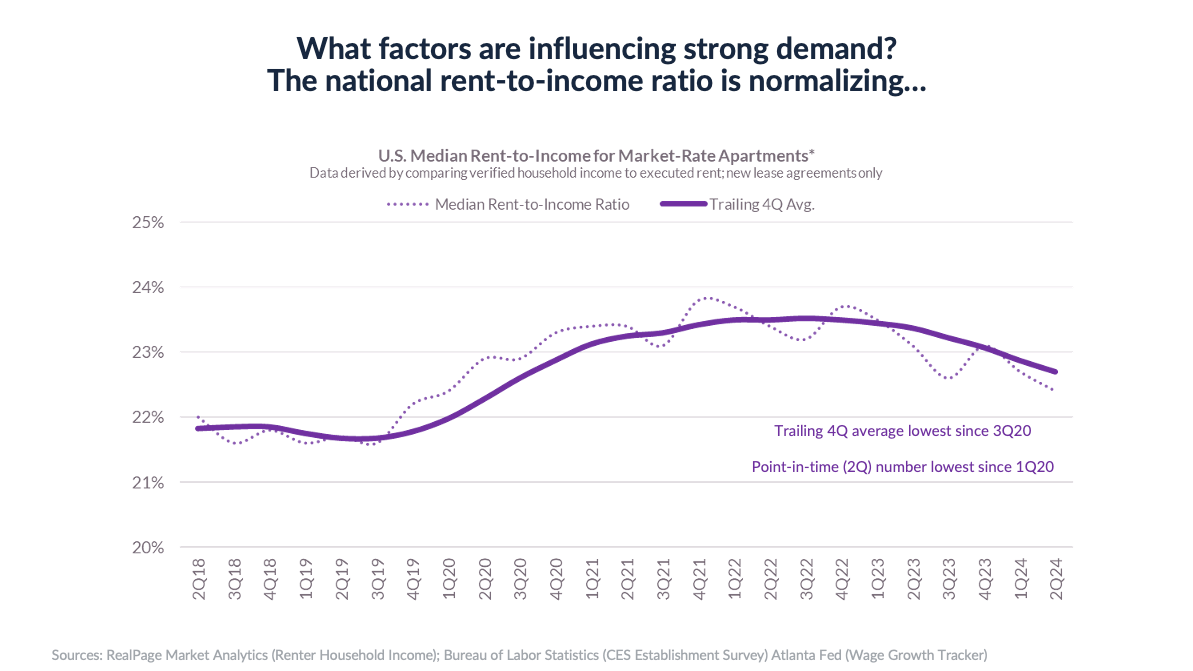

#4 - Pay attention to rent-to-income ratios

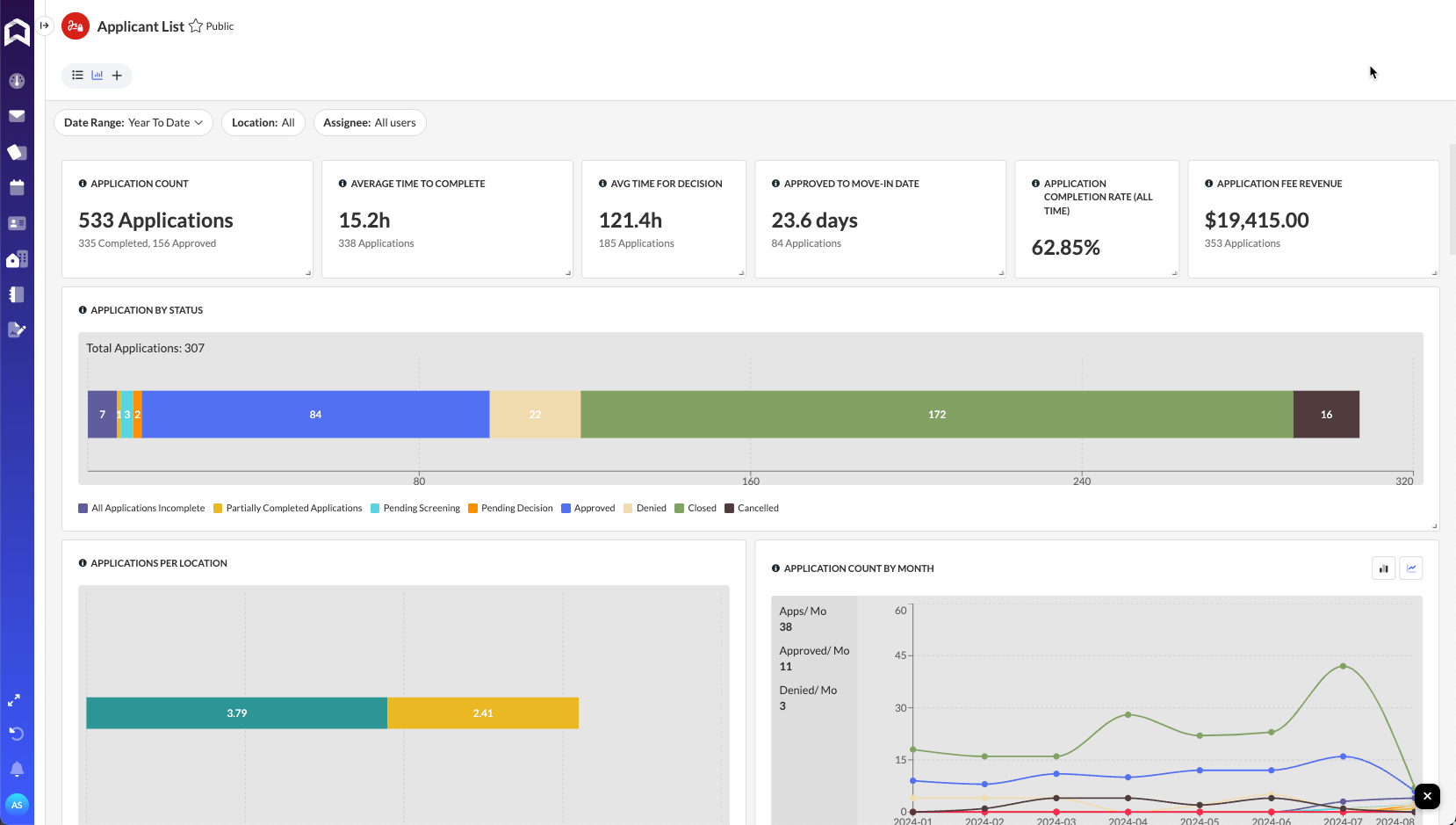

Aptly Screening dynamically calculates rent-to-income ratios as a powerful indicator of a household’s ability to pay rent. We encourage property managers to base this calculation by pulling data from real-time bank connections to eliminate fraud and ensure accuracy.

A rent-to-income ratio calculates the monthly or annual gross income a renter must earn in order to feasibly afford their rent payment each month. If a prospective renter’s income doesn’t meet that ratio, then they will probably struggle with your current rent. According to Chase Bank, the ideal rent-to-income ratio would have no more than 30% of your renter’s annual income going toward housing costs.

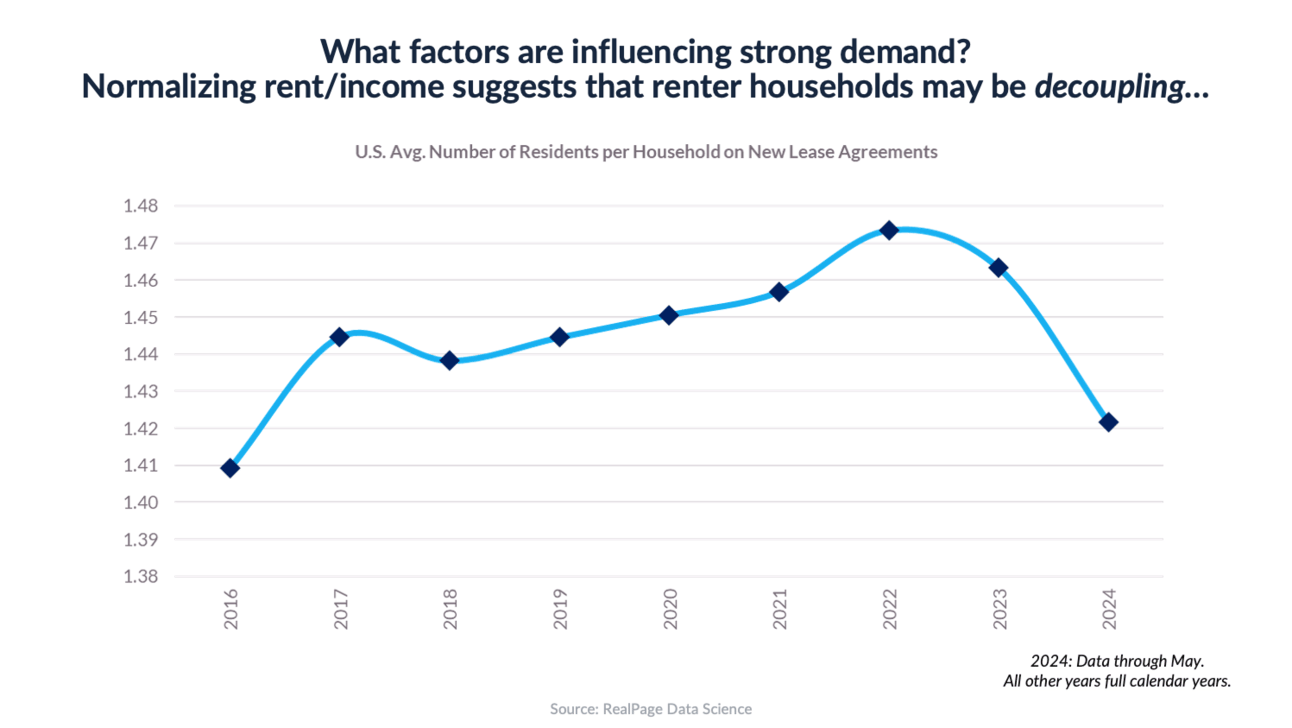

Whitaker shared some interesting data that shows the nationwide rent-to-income ratio are stabilizing below 23%. This is in large part to 3.5-4% increase in wage growth, which is higher than inflation.

This trend is also shifting average household sizes, suggesting decoupling of families or roommates into rental homes.

We make it easy to track this data with Aptly’s Screening reports, providing you a mini-economist that’s staying on top of your regional market trends.

#5 - Pay close attention to fraud

Rental tour and application fraud has been climbing in 2024 and it’s doesn’t show any signs of slowing down with the data we’ve collected on the economy. When housing markets get competitive, it’s the perfect opportunity for scammers to lift your listings and reposition then on other websites for a lower rent rate. It’s just one of the dozens of techniques that end up causing costly evictions and bad debt for your properties.

Aptly Screening can both streamline your application processing, while eliminating fraud. We’re also excited to announce that Aptly Tours will be available by private invite in Q4 of this year, which introduces powerful tools to stop tour fraud while integrating nicely with our screening solution. Stay tuned for more information about this.

That’s it for this week from The Edge! If you made it this far, we appreciate your attention and ask that you invite others to our publication too.

Reply